unemployment insurance tax refund

In that batch of corrections the average special refund was 1189. Theyre sending out 430000 tax refunds.

Stimulus And Taxes How To Shield Up To 10 200 In Unemployment Benefits From Income Taxes Syracuse Com

To request a refund of overpaid Texas Unemployment Insurance Tax send the following to taxrefundtwctexasgov.

. The American Rescue Plan Act of 2021 excluded up to 10200 in unemployment compensation per taxpayer from taxable income paid in 2020. File Wage Reports Pay Your Unemployment Taxes Online. The Internal Revenue Service has just sent out an estimated 430000 tax refunds to people who wrongly paid taxes on unemployment compensation for the tax year of 2020.

Ad Finding a tax return consultant in your area is easy with Bark. UI Compliance Bureau Idaho Department of Labor 317 W Main Street Boise ID 837350760 If. Return completed and signed form to the UI Compliance Bureau by fax.

The Internal Revenue Service is delivering a fourth round of special tax refunds this week to 15 million taxpayers who paid taxes on unemployment benefits when they filed their 2020 tax returns. The American Rescue Plan Act waived federal tax on up to 10200 of 2020 unemployment. Everything is included Premium features IRS e-file 1099-G and more.

We received an invoice for SUI back in 1220 for about 30000. The federal unemployment taxes paid to the Internal Revenue Service Form IRS 940 are used to pay the costs of administration of the unemployment insurance and Job Service programs in. Receive Fast Free Tax Preparation Quotes From The Best Tax Accountants Near You.

Ad Learn How Long It Could Take Your 2021 State Tax Refund. I have 50 left in AP. The IRS has identified 16 million people to date who may qualify for an associated tax refund or other benefit.

WASHINGTON The Internal Revenue Service reported today that another 15 million taxpayers will receive refunds averaging more than 1600 as it continues to adjust. For this round the average refund is 1686 direct deposit refunds started going out Wednesday and paper checks today. We received a refund check from SUI for.

USAPlus-Up Payments may stop on December 31. The IRS says it has identified more than 16 million taxpayers who may be eligible for the special refunds. Irs Tax Refunds.

Contact name title phone number email address. A request for a specific amount or simply please refund all available credit. See How Long It Could Take Your 2021 State Tax Refund.

Ad Premium federal filing is 100 free with no upgrades for unemployment tax filing. As part of the American Rescue Plan. Taxpayers should not have been.

The agency had sent more than 117 million refunds worth 144. Tax Refunds On Unemployment Benefits Still Delayed For Thousands. The Internal Revenue Service has sent 430000 refunds totaling more than 510 million to people who overpaid on taxes related to their unemployment benefits in 2020.

208 3346301 Or mail to. An employing unit that is liable under the Federal Unemployment Tax Act FUTA and has at least one employee in Tennessee regardless of the number of weeks employed or amount of. 50 of that amount was paid in 121.

For any Unemployment Insurance Tax questions please contact the UI Operations Center at 1-877-664-6984 Monday through Friday 800 am. Use our free online service to file wage reports pay unemployment taxes view your unemployment tax account. Who Is Getting Irs Compensation Payments.

2 8 Million People Are Getting Irs Refunds This Week 10 Million More May Get Money Too Wbff

How To Get A Refund For Taxes On Unemployment Benefits Solid State

How To Get A Refund For Taxes On Unemployment Benefits Solid State

Irs Unemployment Refunds Moneyunder30

Report Unemployment Benefits Income On Your Tax Return

Is Unemployment Compensation Going To Be Tax Free For 2021 Gobankingrates

States Are Telling Some People To Pay Back Unemployment Benefits Marketplace

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

How To Claim Unemployment Tax Exemption In 2021 Nextadvisor With Time

Interesting Update On The Unemployment Refund R Irs

America S Jobless Owe Thousands Of Dollars In Taxes On Their Unemployment Benefits The Washington Post

Do You Owe Taxes On Unemployment Benefits You Could Get Hit With A Big Tax Bill

The Irs Has Sent Nearly 58 Million Refunds Here S The Average Payment

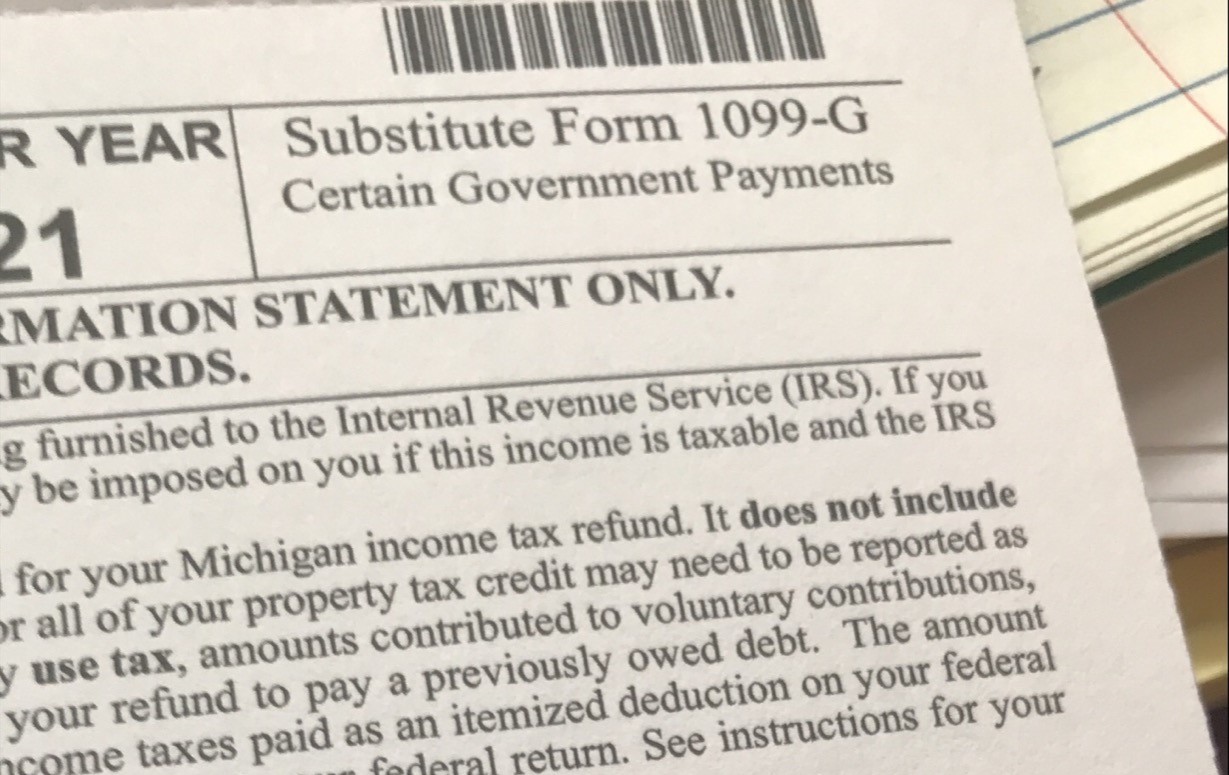

What Is A 1099 G Form And What Do I Do With It

1099 G Unemployment Compensation 1099g

:max_bytes(150000):strip_icc()/1099g-b89de84cce054844bd168c32209412a0.jpg)

Form 1099 G Certain Government Payments Definition

Michigan S Delayed 1099 G Unemployment Tax Forms Now Available Online Mlive Com